WCA 2023 Year in Review

WCA Smart Growth Focus Areas

Upcoming Events

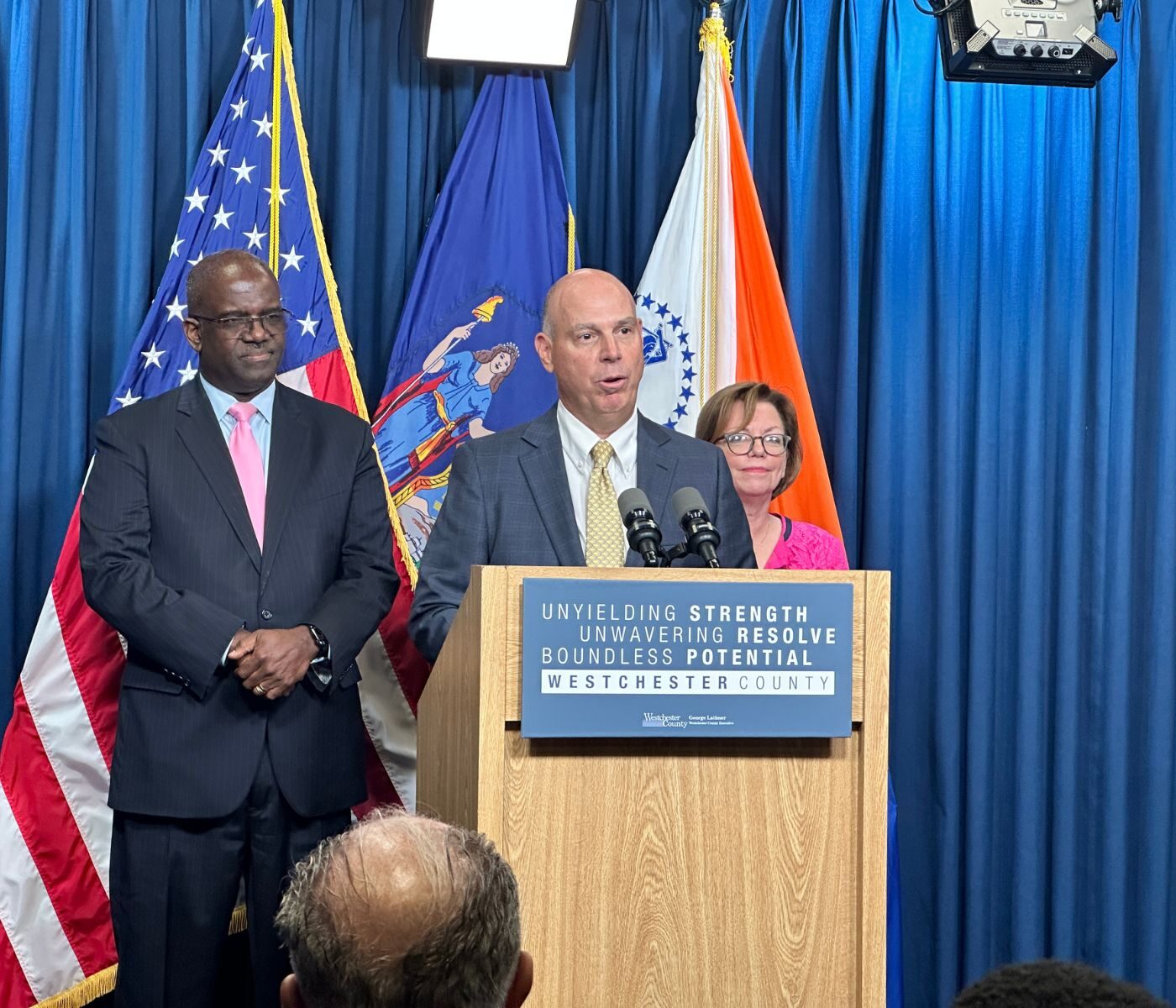

News

The WCA is the most influential community of businesses and non-profits in the region.

Employers: Don't Miss Your Chance to Meet and Interview Local Talent

On Wednesday, April 10, the Westchester County Office of Economic Development and Untapped Solutions will host a Job + Resource Fair for those who are justice-impacted and other underserved populations. READ MORE

Harrison Edwards Welcomes New Clients

Harrison Edwards Integrating Marketing is pleased to announce that we have welcomed two new organizations to our family of clients: READ MORE

Pace U Invites Employers to Recruit at Job Fair April 5

Employers will have the opportunity to meet hundreds of motivated candidates with first-rate skills and experience, eager to be recruited for full-time positions and internships. READ MORE